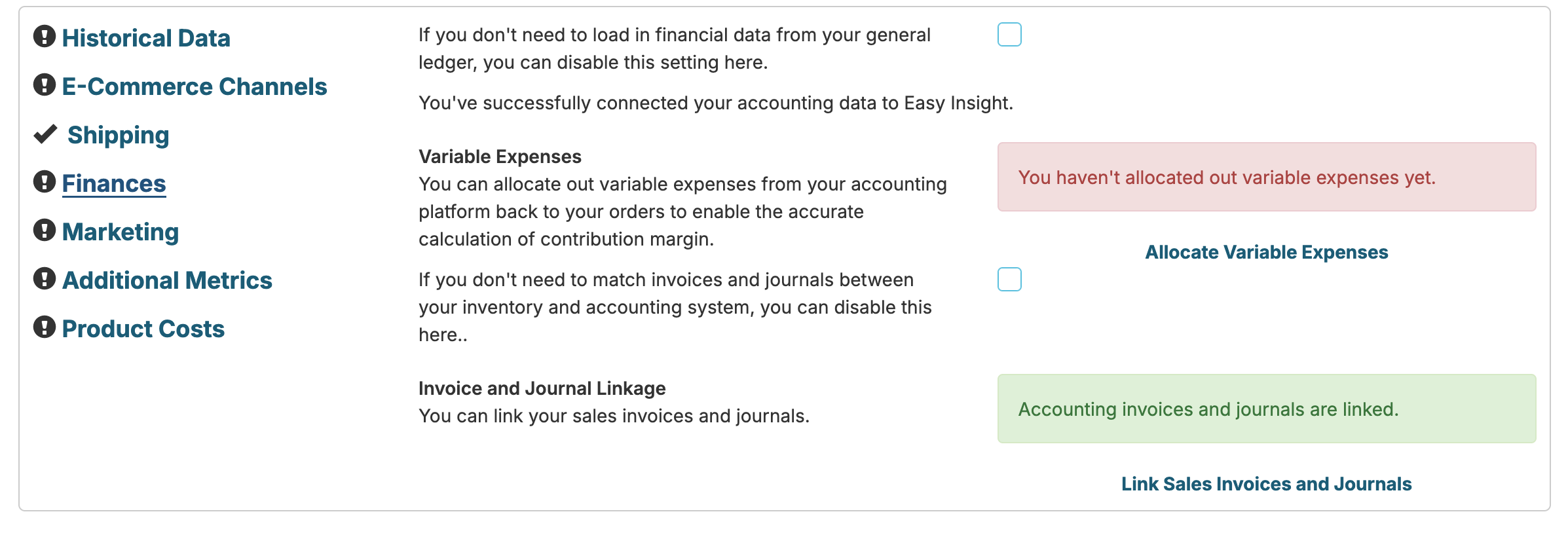

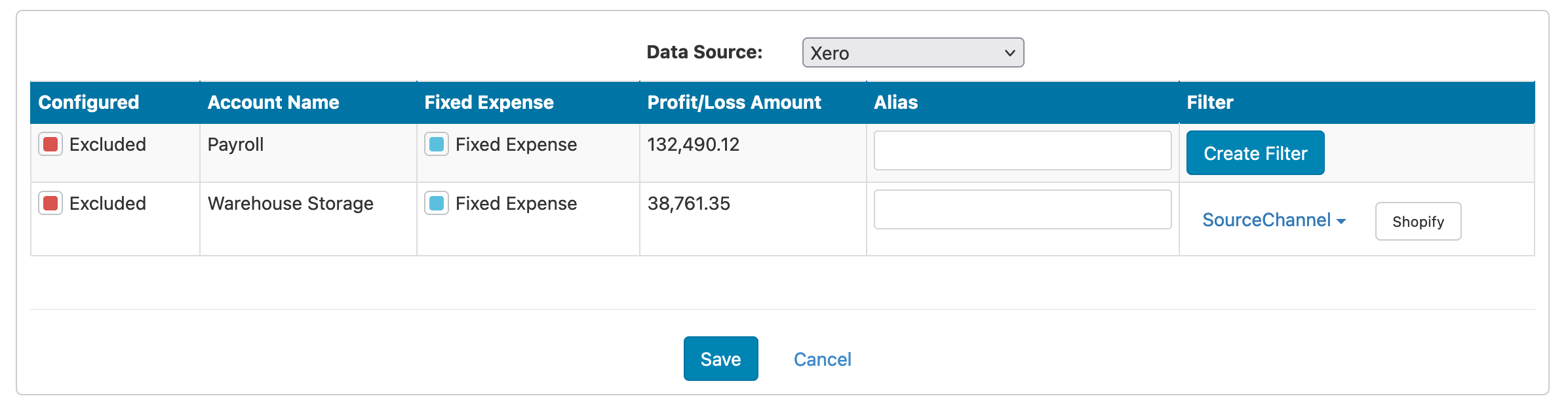

For a given month and account's profit and loss, it needs to be allocated across your orders in some way. When allocating variable expenses from your accounting system to contribution margin, you can choose the field for weighting allocation and optionally add a weight field to apply a further weighting to the calculation. For example, if you have $50,000 in fulfillment costs that you need to allocate across your orders for December, you can choose to allocate that $50,000 per order, weighted by individual order total, or something else altogether. Maybe for your business, it makes sense to weight based on the physical weight of the items in the order. You can choose the allocation field on this page in order to configure how the costs are allocated.